The Best Strategy To Use For Accounting Franchise

Table of ContentsThe Main Principles Of Accounting Franchise Little Known Facts About Accounting Franchise.An Unbiased View of Accounting FranchiseThe Ultimate Guide To Accounting FranchiseAll about Accounting FranchiseWhat Does Accounting Franchise Do?Get This Report on Accounting FranchiseThe Accounting Franchise Statements

Ask any type of prospective company for details on the most useful tasks they have actually finished for clients after that go talk to those clients, especially those that run organizations of comparable size and complexity to yours. Those are individuals that can verify whether or not the firm you're taking into consideration has the competence you look for.3 - Accounting Franchise. Readiness Prior to Garrett hired RSM, he asked several firms to clarify industry modifications in tax obligation regulation and audit criteria. "I didn't obtain extremely constant, proficient responses from many firms," he states. "However RSM simply was available in like, "We've done it. Here's how it is. Speak to our partners, speak with our customers.'" What he anticipated: Wild Bill's offers soft drink and mugs at large occasions.

From the franchisor's monetary health and wellness to the first financial investment required, continuous costs, and also litigation background, the FDD uses a thorough explore the franchisor-franchisee partnership. Understanding the FDD is essential for brand-new franchisees, as it equips them to make educated choices about their investment. By evaluating the paper, possible franchisees acquire clarity on the threats, responsibilities, and prospective incentives connected with signing up with the franchise system, guaranteeing they get in right into the collaboration with eyes broad open.

The smart Trick of Accounting Franchise That Nobody is Talking About

Franchise business often have ongoing nobility charges, advertising and marketing costs, and other expenses not regular of independent organizations. First and leading, you'll wish to see to it you're conscious of all of the franchise business fees you'll be subject as well. Secondly, you'll wish to make sure these charges are consisted of in your financials, and make certain your accountant or accounting professional is conscious as well.

Several service proprietors and franchisees start off thinking they can do it all on their very own. Instead of taking treatment of your own publications, it pays to hand them off to professionals.

Not known Details About Accounting Franchise

It's one point to have your financials created every month, it's one more point to comprehend them and use the numbers to your advantage. When you start as a brand-new franchisee, it is very important to develop a strong fundamental understanding of monetary declarations (revenue & loss, balance sheet) to keep an eye on performance.

From the beginning, establish a system for tracking receipts, invoices, and various other monetary records for tax and reporting objectives. This is often performed in accounting software program, where access is then provided to a bookkeeping specialist to keep an eye on and create reports for monthly tracking. Mentioning reports, staying in song with and in addition to your finances and estimates is another method to remain successful and range.

Again, we can't worry this enough. Don't hesitate to seek support from a qualified accounting professional with franchise expertise. Whether it's tax preparation, accounting, compliance, or various other areas, outsourcing tasks that you're not an expert in will certainly permit you to concentrate on the day-to-day procedures while the professionals take care of the rest.

How Accounting Franchise can Save You Time, Stress, and Money.

For franchise business owners, navigating the intricacies of accountancy can be a daunting difficulty. However, with specialist, business can open the capacity for. The solution can range from handling and to enhancing payroll and. Specialist audit solutions customized particularly for franchise business and local business owners in the US can make all the distinction in ensuring Franchise accountancy goes beyond common bookkeeping; it's around,, and maintaining compliance with and income tax return - Accounting Franchise.

Franchise accounting solutions help deal with the certain set by. Reliable monitoring of franchise financial resources is a key focus location for services.

These experts have the Go Here expertise to navigate the particular intricacies connected to franchise taxes, guaranteeing precise and prompt tax obligation conformity for franchise companies. For have a peek at this site instance, they handle different elements such as sales tax coverage, payroll tax compliance, and income tax obligation prep work customized to meet the unique requirements of franchises. Additionally, these experts are experienced at attending to the intricacies linked withthat usually impact franchises operating across various regions.

Accounting Franchise for Dummies

Franchise bookkeeping solutions are skilled in taking care of any type of unique considerations associated to if a franchise runs outside its home nation. They guarantee that all conform with relevant legislations and guidelines while also enhancing tax obligation advantages where appropriate. These professionals focus on to make best use of tax obligation cost savings especially customized for franchise business.

Professional accounting for franchise business entails precise interest to detail, guaranteeing of earnings, expenditures, and other monetary deals for the firm. This level of know-how is crucial for giving accurate insights right into a business's monetary health and wellness. These recognize the complexities involved in managing several areas or systems within a franchise business system.

These on-demand advising solutions permit franchise business to benefit from the proficiency of without needing to hire them permanent. It's like having a team of skilled advisors readily available whenever needed, providing important insights right into monetary matters distinct to the franchise business industry. New franchise business obtain committed from who specialize in attending to the financial elements specific to brand-new company setups.

The Only Guide to Accounting Franchise

By incorporating accounting software application perfectly into franchise business operations, services can improve their financial procedures. Utilizing integrated software program enables franchise business to handle various facets of their financial procedures properly. For example, it helps in automating jobs such as invoicing, pay-roll management, and cost monitoring. Therefore, the entire procedure comes to be more efficient and much less vulnerable to mistakes.

Franchise business can likewise gain from via seamless assimilation. This indicates that all monetary details is saved in one place, making it less complicated for franchise business proprietors and supervisors to accessibility important information when needed. Franchise business can leverage the abilities of to enhance coverage and analysis. Qvinci's permit read what he said franchise business to generate extensive financial reports with simplicity.

As franchise business expand, there is a growing demand for specific accountancy solutions to manage the financial elements of several places. This produces a need for accounting professionals with knowledge in franchise audit. Browsing the landscape of franchise opportunities entails recognizing development prospects and growth opportunities. For example, as even more services select franchising versions, there's a boosting demand for across locations.

The Greatest Guide To Accounting Franchise

With clear records, franchisees and franchisors can rapidly gauge their economic health and wellness, recognize which services are one of the most lucrative, and figure out where expenses might be cut. This clearness is not just for the organization proprietors yet additionally for stakeholders, investors, or perhaps for prospective franchise customers. Prompt settlements to vendors, timely pay-roll, and reliable stock monitoring are some functional elements that rely on precise accounting.

Every business, consisting of home solution franchise business, has tax commitments. With accurate publications, a franchise can guarantee it pays the correct amount of tax not a dime much more, not a cent much less. Furthermore, a properly maintained record can aid in use tax obligation advantages, deductions, and credit scores that a franchise may be eligible for.

Unknown Facts About Accounting Franchise

Banks, loan providers, and investors often think about constant and exact bookkeeping as an indicator of a business integrity and reputation. While it may seem like accounting contributes to the tasks of a franchise, in the future, it saves both money and time. Imagine the effort required to backtrack and recreate financial statements in the absence of routine accounting.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Burke Ramsey Then & Now!

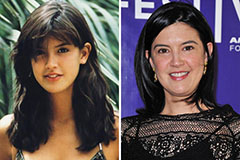

Burke Ramsey Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!